How to Build a Website for a Business: A Complete Guide

Learn how to build a website for a business step-by-step, achieving a professional online presence tailored for success.

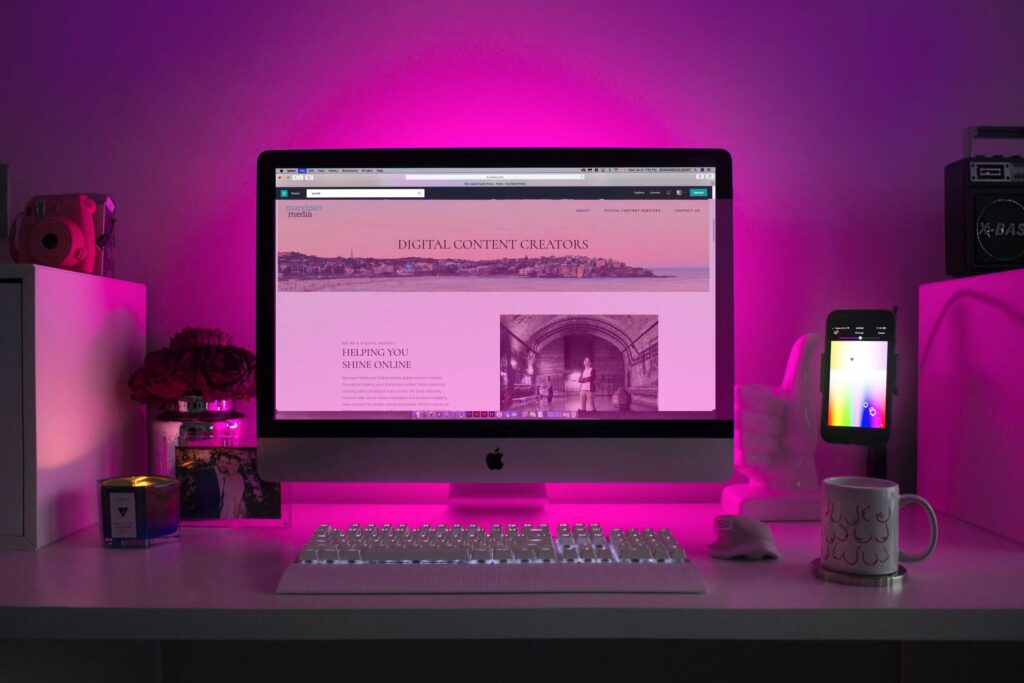

How To Create A Website For Your Business

Websites are the main hub of your business in an increasingly digital world. No matter what size of business, it’s definitely worth considering if you want an online presence. A website expands your brand, informs potential customers, and drives sales upwards when done correctly. Today, we will be discussing how to build a website from […]

Australian online shopping habits

We dive into the latest Trends Report from Facebook to discover Australian online shopping habits in a new Covid world.

8 Steps for Paying Employees of Small Businesses

If you’re a new business owner, learning how to pay your employees may seem tricky. After all, you can’t just hand them a wad of cash. You need to document every dollar that passes through your hands to theirs in a legal way. Fortunately, the process isn’t as daunting as it seems. In this guide, […]

How to Survive the Pandemic as a Freelance Content Writer

With the COVID-19 pandemic hitting the world, life is not the same. While it has impacted every industry, the plight of the self-employed workforce is beyond imagination. They are neither getting employment nor are they eligible for government’s financial aid benefits. Dealing with the loss of business, restrictions and a lot of mental and emotional […]